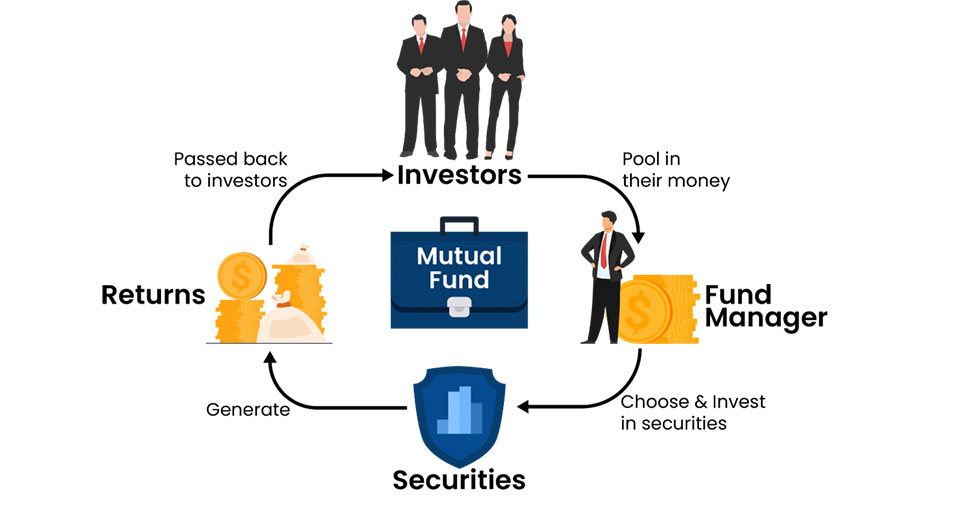

In order to invest in securities such as stocks, bonds, money market instruments, and other assets, mutual funds aggregate the funds from shareholders.

Professional money managers run mutual funds, allocating the assets and attempting to generate capital gains or income for the fund’s investors. The portfolio of a mutual fund is set up and kept up to date in accordance with the specified investment goals in the prospectus.

Small or individual investors have access to professionally managed portfolios of stocks, bonds, and other securities through mutual funds. As a result, each shareholder shares proportionately in the fund’s profits or losses. Mutual funds invest in a huge variety of assets, and performance is often gauged by changes in the fund’s overall market capitalization, which are obtained from the performance of its underlying investments combined.